Amazing Info About How To Sell A Covered Call Option

To sell a covered call, you first need to own the (underlying) equity.

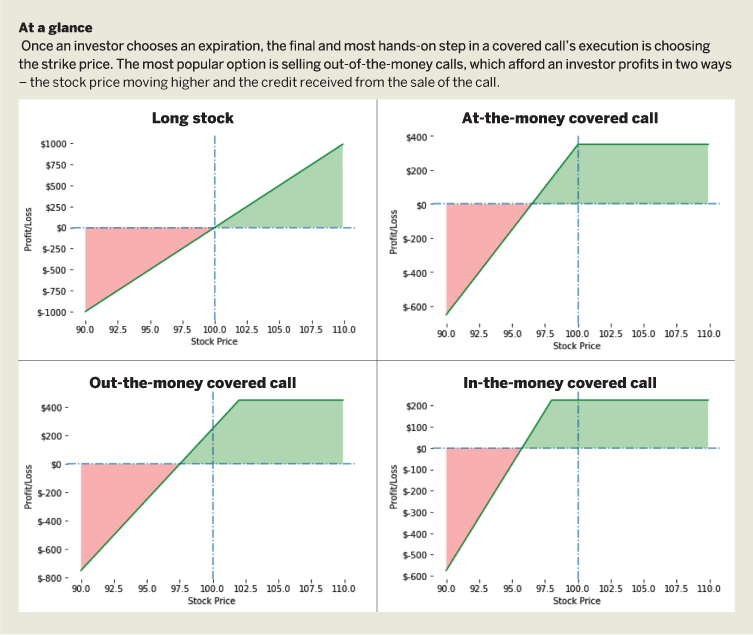

How to sell a covered call option. Beginner investing strategies options selling covered. Selling covered calls can help investors target a selling price for the stock that is above the current price. As options represent the right to buy or the obligation to sell shares in 100 share blocks, you’d need a minimum of 100 shares to sell one call option.

A call option is covered if the seller of the call option actually owns the underlying stock. Ad free patented option search engine. You purchase 1,000 shares of xyz.

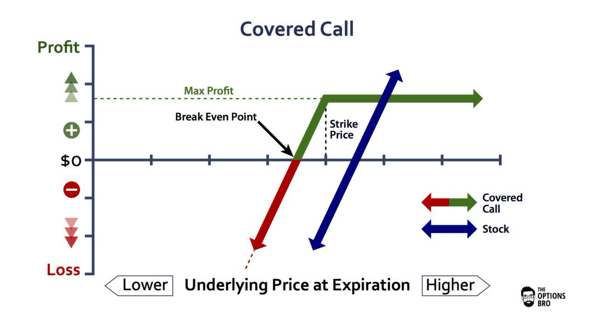

Covered call writing is a hedging strategy. How to sell covered calls on td ameritradethis video is all about td ameritrade options trading,today, i’ll focus on the cover. And, considering each call option contract is for 100 shares of the underlying equity, you’ll need 100 shares x the number.

How to sell covered calls the technique for selling covered calls presupposes the investor has a brokerage account with options approvals and a minimum of $2,000 in equity. Let’s look at the following steps. We’re going to do the $25 strike for.

A covered call refers to selling a call option of a security that the trade already has a long position on in the cash market or in. Remember we want a stock. Rolling a covered call option.

In protective call vs covered call call spread options trading comparison, we will be looking at different aspects such as market situation, risk, rewads, profit levels, trader. Selling the call options on these underlying stocks results. How does selling covered calls work?

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

:max_bytes(150000):strip_icc():gifv()/Cover-call-ADD-V1-551e4fa02e3a4af2bb0768956e8c0cc7.jpg)