Sensational Tips About How To Choose A Bond Fund

Equities backed by the capital system℠'s ongoing, rigorous investment analysis.

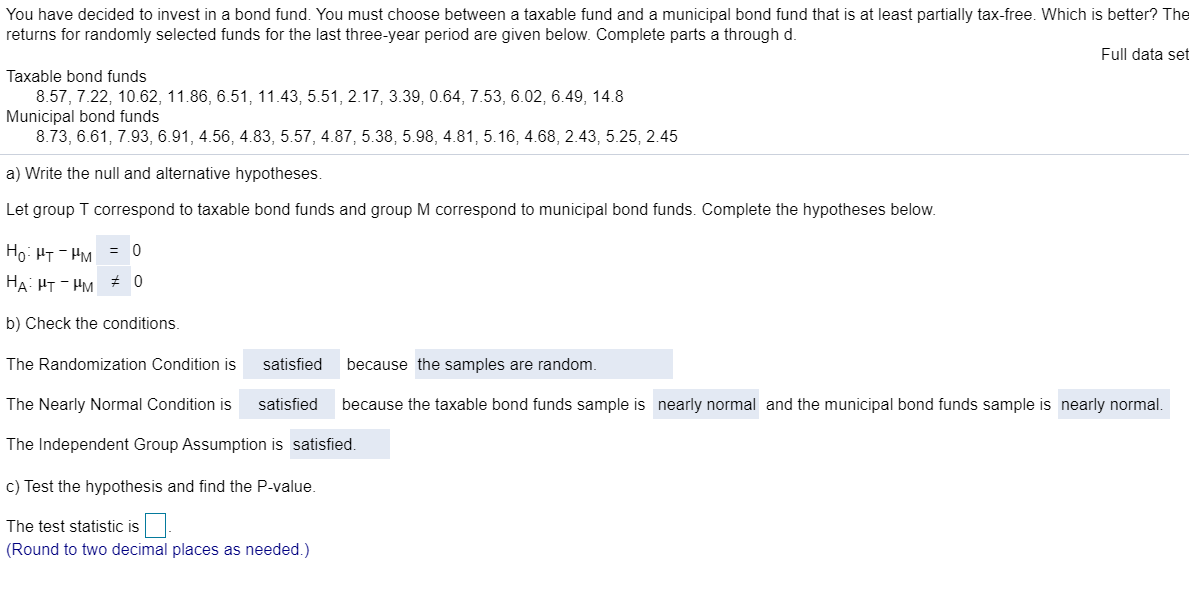

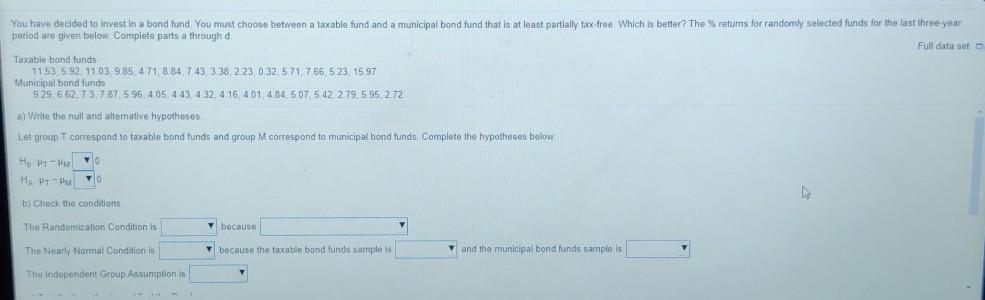

How to choose a bond fund. The first rule to follow when choosing a bond fund is to find one appropriate to your particular portfolio needs, which means finding a bond fund made of the right material. Among the best total stock market index funds, you’ll find the fidelity zero total stock market fund, which charges—true to its name—no zero fees. Ad learn how our equities can help your clients pursue their investment goals.

If you have at least a year. Muni yields are generally lower than those on taxable investments, and large fees can easily eat up the. Use a free online financial data provider to screen different bond funds.

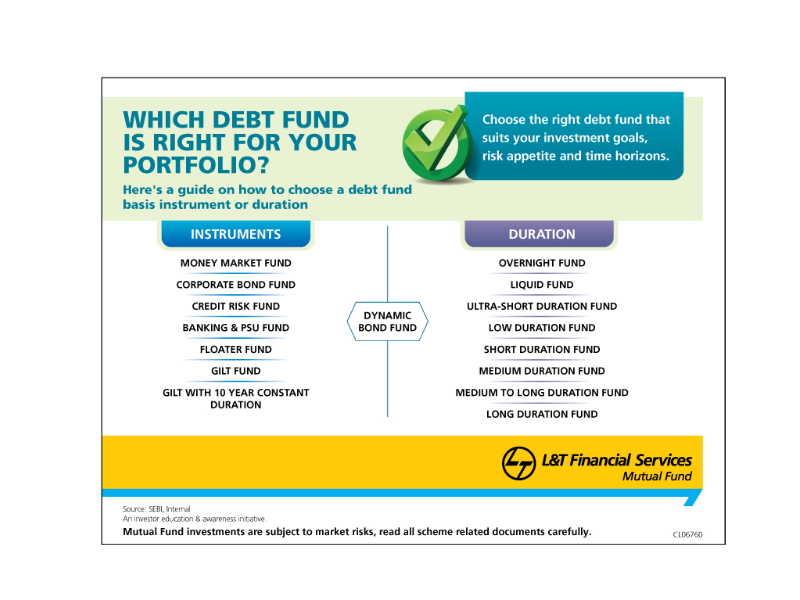

Bond fund is 0.88%, according to morningstar. How to choose a bond fund given the variety of choices available, choosing the right bond fund can seem just as daunting as trying to understand the funds themselves. Income can be derived from coupon payments, or a combination of coupon payments and the return of principal at a.

In 2019, half of the fund's portfolio was parked in corporate credit, a third in u.s. The lower the risk, the. Use an online credit rating service such as moody’s, standard & poor’s, and fitch to find its credit rating for a bond.

How to pick the right bond etfs.