Fabulous Tips About How To Handle Short Term Debt

6 tips on how to successfully handle short term investments tip 1:

How to handle short term debt. Ad compare best debt consolidation companies of 2022. The need to comply with covenants, or conditions, that often are imposed by lenders. You would need to reduce the loan to approximately $375,000 (60% ltc) to get to a 1.0 dscr.

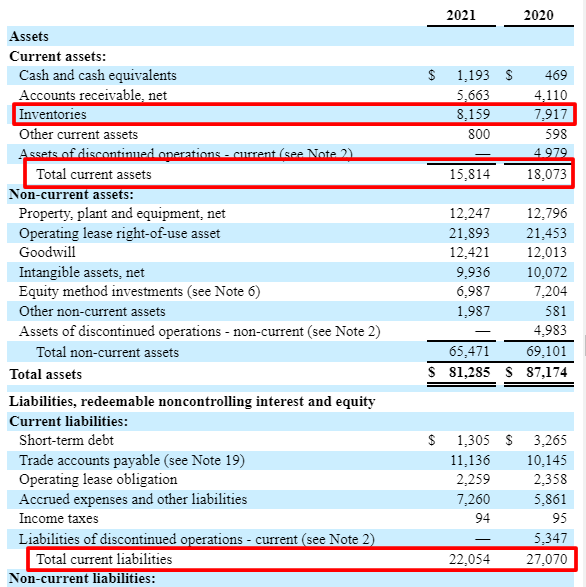

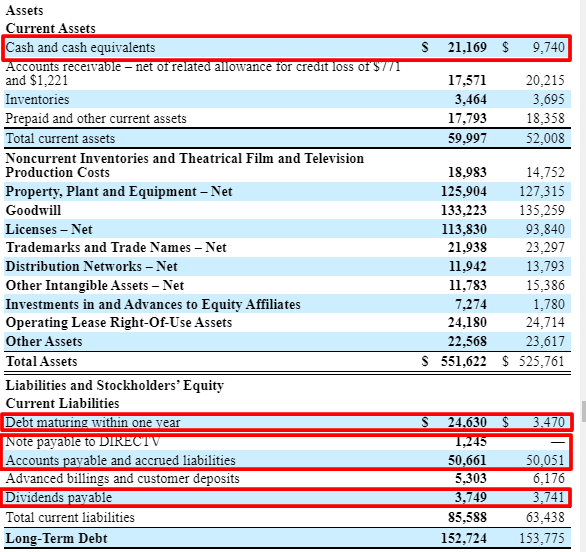

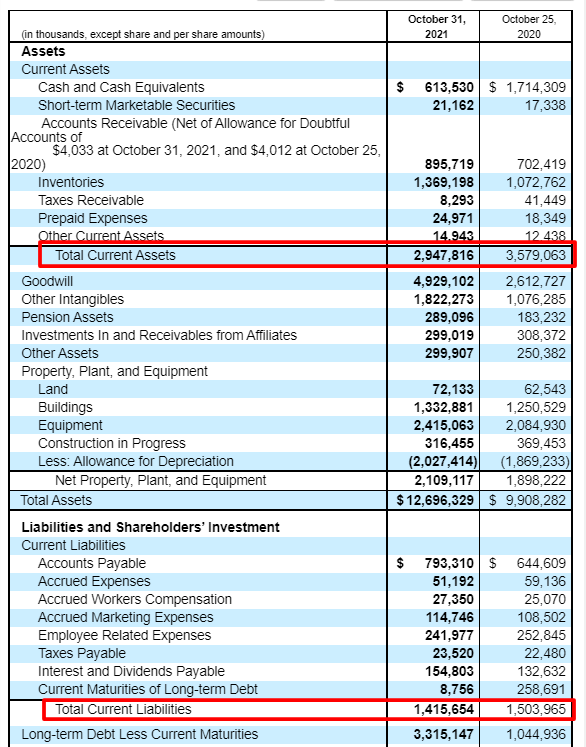

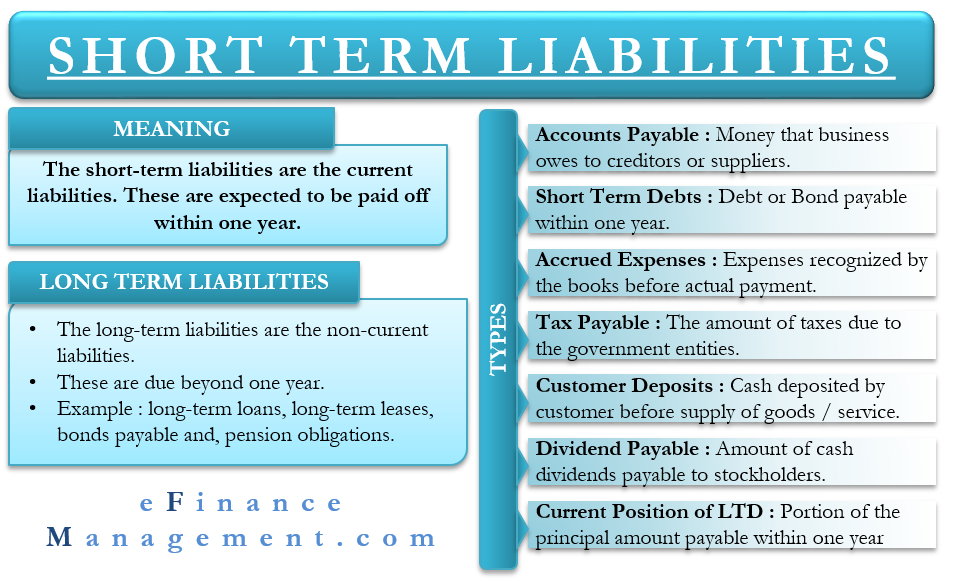

If the account is larger than the company's current cash and cash equivalents, it may indicate the company is financially unstable because it has insufficient cash to repay its. Without access to savings, you’d have to go into debt to cover an emergency expense. Apply now & payoff your debt!

Even a small emergency fund will cover little. Use our comparison site & find the best debt solutions | skip the bank & save! Know the different types of short term assets.

Ad are debt worries keeping you awake at night? Debt consolidation reduces the amount you have to pay. Build an emergency fund to fall back on.

You would be required to bring an additional $125,000 to closing…ouch! With most debt help plans, creditors accept lower payments or agree to reduce or. Best debt consolidation of 2022.

Apply online for low rates. Senate minority leader mitch mcconnell is offering democrats a way to raise the debt limit briefly and keep the nation from tipping into default in the short term, and majority. It can also be used to take advantage of early payment discounts from suppliers.